Intro

Let’s talk about global warming.

Those that know me

Because no other problem threatens us so deeply and definitely. No other major problem

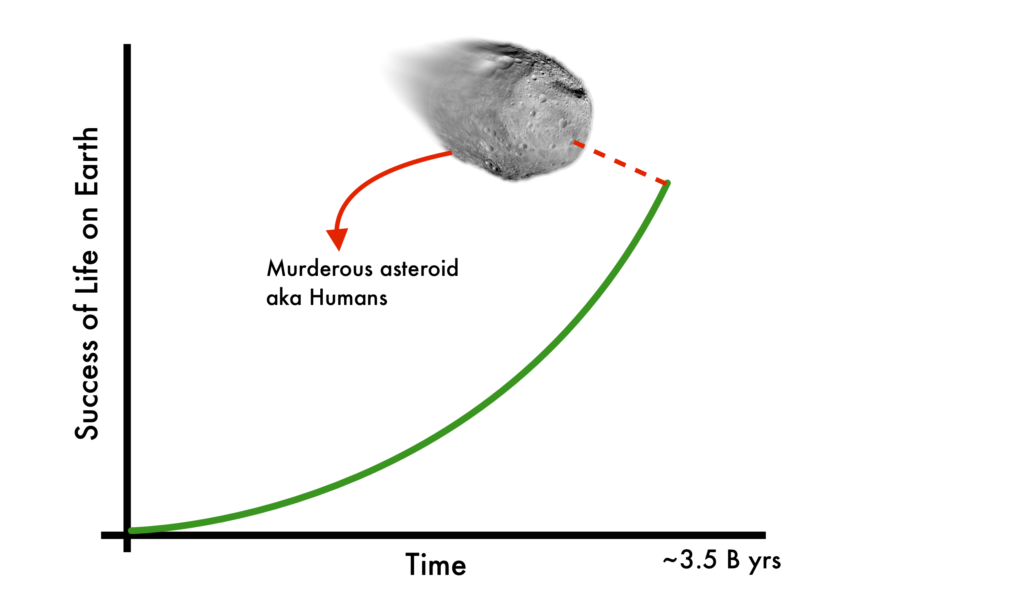

Essentially, humanity has put the biosphere on a trajectory of worldwide destruction, and the inertia of this trajectory is monumental. It’s a massive challenge to chance the course of a meteor, and that’ basically what we have to do. It’s the meteor that killed the dinosaurs all over again, except this time the meteor is us.

It makes sense that a huge number of people have joined forces to do something about it. There are hundreds of organizations attacking various parts of the problem, from forest

There are also other, less direct groups that attempt to solve the root problem: carbon emissions. These organizations range from lobbyists who try to implement subsidies for renewable energy companies to scientists and engineers who propose

But the truth is: we’ve seen little progress. CO2 concentrations are showing no sign of leveling off, let alone going down.

So, what have we tried so far? We’ve tried energy subsidies to make solar energy economical. The result? Although solar and wind are

We’ve also tried international agreements, such as the recent and historic Paris Agreement. Don’t get me wrong, it’s extremely important that the international community gets together to set goals and establish climate change’s importance. But agreements like the Paris agreement are unlikely to reduce worldwide emissions significantly due to lack of enforcement provisions and, frankly, because the targets are so unambitious they are unlikely to have a dramatic effect.

Finally, there’s one more concept for tackling climate change, and that’s the subject of this post: the Carbon Tax. It’s been implemented by such countries as Denmark and Norway, and in theory, makes a lot of sense. Let’s take a look at exactly what a carbon tax is.

The Concept of a Carbon Tax

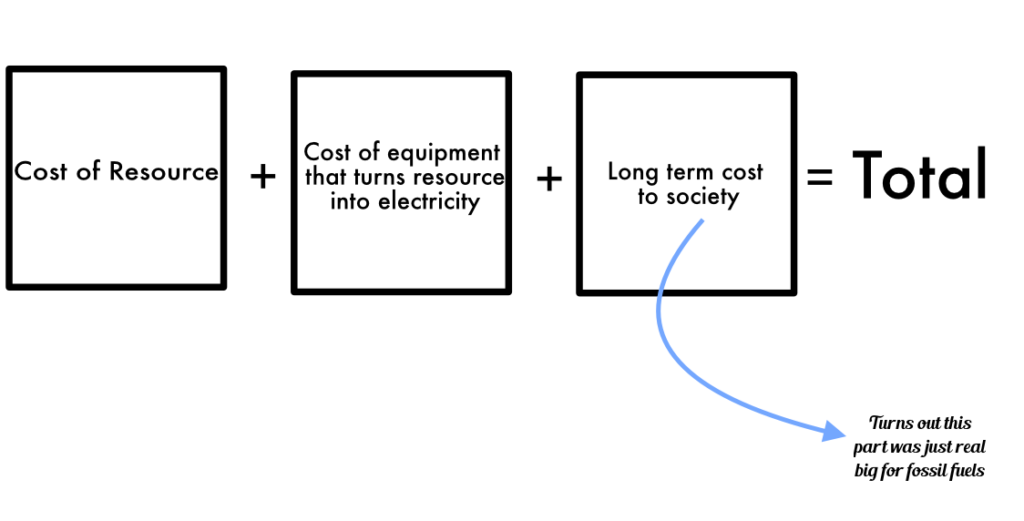

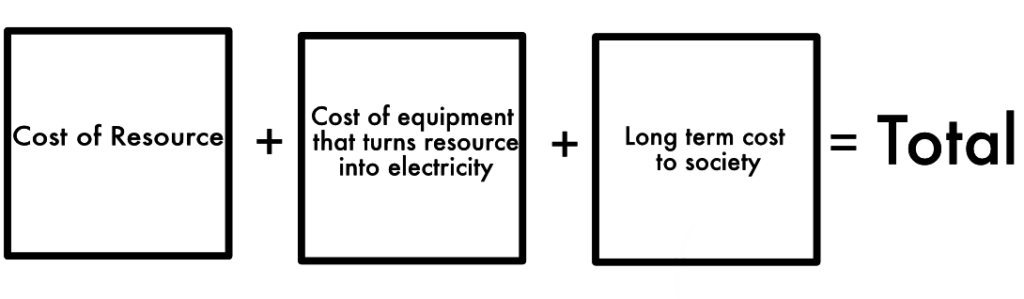

The Carbon Tax, in

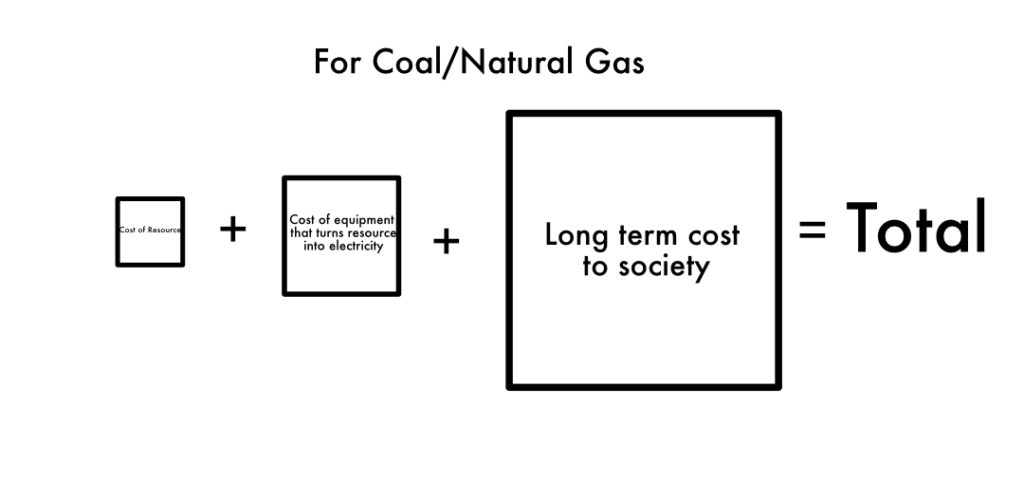

For coal:

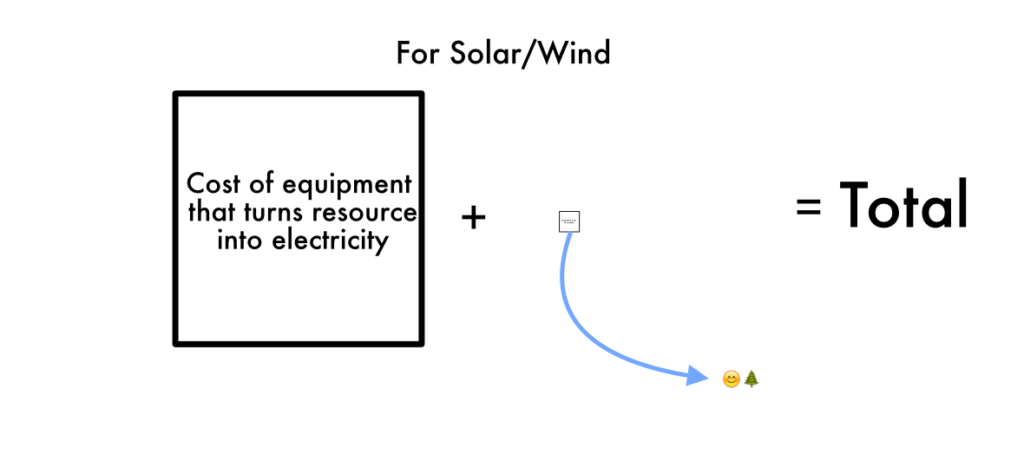

For solar/wind:

Essentially, if a carbon tax is to effectively incentivize renewable energy, then the long term cost to society must dramatically outweigh the reduced cost of electricity generation equipment. The hypothesis is that if “true” costs are factored in, fossil fuel sources of energy will be so expensive that sources of renewable energy will be able to compete.

Now, that all makes complete sense.

This has the support of extremely intelligent, informed, and passionate people, including Elon Musk.

So it all seems simple, with the key being how to, exactly, calculate the true “cost to society.” But as we shall see, that’s a bit more difficult than it sounds.

Why Icebergs Are Important

But first, let’s talk about icebergs and ships. Let me tell you the story of one fateful ship; you might have heard of it. The RMS Titanic is perhaps the most famous ship of all time.

It was also a spectacularly bad ship to be aboard. All of its technological advancements couldn’t save it from the human problem of poor decision making and poor vigilance. At 11:40 PM ship’s time, April 14th, 1912, lookout Frederick Fleet spotted an iceberg directly ahead of the Titanic. He shouted below, but it was too late. Although First Officer William Murdoch ordered the ship to turn hard left, and put the engines in full reverse. It was too late. The inertia of the 52,310-ton ship was too much to overcome, and it impacted.

By 2:20 AM it sank, and 1,503 people lost their lives.

Why did the Titanic sink? Why was it going so fast in a known iceberg field? Why was the lookout not given a pair of binoculars? Why were there not adequate lifeboats and emergency procedures? Why weren’t they prepared for an iceberg while nearly in the Arctic?!?!

Funny enough, there is a single answer to all of those questions: hubris.

Let me explain—it wasn’t solely the fault of those aboard the ship at the time, although they displayed plenty of the quality. It was a combination of them and society’s hubris.

- First, it was widely believed the ship was unsinkable. The captain, Edward Smith, once said in 1907 that he “could not imagine any condition which would cause a ship to founder. Modern shipbuilding has gone beyond that.” We thought ourselves above nature. Always a mistake.

- Second, it was common practice at the time to not slow down, even for known iceberg conditions. Again, we would find it common sense that if there were known ship destroying objects in the area and the ship was operating in poor visibility (such as at night) that the ship would slow down. But no. That was seen as unnecessary, because, after all, “modern shipbuilding has gone beyond that.”

- Third, no one thought it necessary to give a lookout binoculars. Let me repeat

that, because the stupidity is too much for me. No one thought to give the person whose job it was to see ahead of the ship and keep it safe the most common piece of sight augmentation equipment? And the lookout himself never thought to ask for it? I guess he thought his natural vision was good enough. - Fourth, the Titanic was not equipped with an adequate number of lifeboats. Although it was indeed up to regulation at the time, that’s no excuse for an abdication of common sense. They thought that they could be used to ferry those aboard to another ship. But no other ship came. The only one in range to save those aboard had not acted, likely because they believed it too unlikely that the Titanic was sinking. There’s also substantial evidence that extra lifeboats were not included because they ruined the visual appeal of the ship. Aesthetics, or lives? Hubris—they were believed to be an unnecessary burden.

- Fifth, they weren’t prepared— and for no other reason than

that they believed themselves to be invincible. They believed themselves to be above nature. Like a teenager driving a car 100 miles per hour on a canyon road, they believed they were talented and equipped enough to handle the risk. But they gambled not just with their lives, but with the lives of 2,228 people. And they lost.

Now, what do the Titanic and icebergs have to do with a carbon tax? As you might have guessed, it’s an analogy.

Let me paint a picture for you. It’s of this incredible globe in the shape of an iceberg. Not just any globe—but a kind of representation of everything great about the Earth: its diversity of life. An odd combination, I know, but go with me for a second.

In that ice-globe are the world’s ecosystem and the world human economy. Everything a carbon tax might effect. It’s an incredibly beautiful ice-globe, full of all the beauty the Earth contains. And we, humanity, are the Titanic. We’re steaming forward, full ahead, on a path of destruction.

Just like the real Titanic, if we were to hit the iceberg, we’d sink. And just like the real ship, we are full of momentum in the wrong direction and have near-

We’re currently bearing down on it, but it’s not too late to turn. Yet, we can’t wait until we’re just about to hit it to turn. If we wait that long it will be too late. We must turn before that. We must turn soon. We must turn now.

While a nice analogy for the current climate situation, this ice-globe is also a very apt tool to explain the carbon tax.

Let me show you again the ice-globe.

You’ll notice 3 distinct parts. And different parts are of different importance to our ship there.

- First is the part above water. That’s the part our lookout sees. The part that is obvious, dangerous, and that we can take note of. Any person would recognize the

peril, and agree that we must avoid that big dangerous pointy section. - Second, is the part that sticks out underwater. This part is also dangerous for the ship. Now, we on the ship can’t see where this is, but we know it’s there. It’s common knowledge for ship captains, and any captain with experience and knowledge will know to watch out for this. So, the captain will give the pointy section a wide berth to avoid this dangerous protrusion. But, in the end, it can be managed and compensated for.

- Third, there’s the part that no one sees or cares about. It’s the foundation of the iceberg, directly under the middle and deep underwater. The captain doesn’t care about it because it’s not dangerous to the ship. But remember, this iceberg isn’t any old hunk of ice. It’s an ice-globe. It’s a representation of the entire biosphere and economy. It’s… everything. And this section is the foundation. So although this part of the structure isn’t important to anyone on the ship, no matter their knowledge or experience, it is vitally important to anyone who cares about the survival of the ice-globe.

Now, the carbon tax.

Remember the carbon tax formula?

That last square is the carbon tax, but the problem is that estimating this long-term cost to society is way harder than it seems. In this calculation, there’s a lot more than immediately meets the eye.

In this way, estimating a carbon tax is a lot like trying to determine the size of the iceberg. There are some obvious parts, there are some areas that are hard to estimate but guesses can be made, and then there are parts that are simply unfathomable.

So, here we are, sitting on our small ship attempting to estimate the entirety of the vastness of the ice-globe we see before us.

Due to our vantage point in our ship, it’s very hard to do just by sitting on a ship above water. Yes, you know how much ice is protruding, and yes you can skirt around the part you see to take care of the protruding bit underwater, but you have no idea how much is underneath. You have no idea how to estimate the size of the foundation. It’s fundamentally impossible to guess.

Let’s delve into this a little deeper. Let’s unpack the analogy. Let’s understand the carbon tax.

Part 1: Things that are Obvious and Calculable

This is the easy part, this is determining the amount of ice that is protruding above the water line. If I were a ship captain, I could circle the iceberg, making polygonal approximations, using compass and map triangulations to make a pretty damn good estimate of the size. If my determination was later audited, I could back up my finding with pages upon pages of calculations and data to prove beyond a doubt that my calculation of the volume of ice was correct. It’s bulletproof.

The same is true for some specific impacts CO2 emissions have on society. Let’s have a few case studies:

Case Study A: Healthcare & Decreased Productivity Costs

Because of increased CO2 concentrations, there will be an increased average temperature. That means more frequent and higher temperature heat waves and fewer cold nights. To estimate the economic cost of this, all you have to do is identify every disease and associated expense that is involved with heat (heat stroke, etc.) Once identified, you can establish statistical baselines, and as the temperature increases, you can attribute the increased occurrences and expenses to each fraction of a degree in average global temperature increase. Then, you can calculate the effect of 1 gram of CO2 has on temperature (which is very difficult but not impossible) and charge the emitters proportionally. By repeating this process with every condition traceable to increased temperature, you could actually get a pretty accurate idea of what the effect is. Of course, there are numerous conditions that would have an increasing occurrence, beyond just heat specific conditions. Because heat is a stressor on the body, it increases the occurrence of nearly every other condition. Yet, still, it is possible to estimate this.

Finally, you can calculate on a per-person basis how much productivity was lost due to their time off from work to recuperate and tabulate the economic expense of this cost to their respective employer. Repeating this over the entire population will give you a number you can add to the overall social cost.

Case Study B: Increased Air Conditioning Costs

This one is pretty simple, right. The Earth is hotter, so we have to run our AC more to keep us cooler. Just like before, establish a statistical baseline, then charge emitters the discrepancy.

But it’s not quite that simple. How do we determine how much AC units are being run? Current power meters do not discriminate between appliances, so it would be difficult to have a provable data set in terms of increased energy usage. And what about those who did not previously need AC units that need to buy them now to stay safely (and comfortably) cool? Is there some calculation that entitles people to a free AC unit, courtesy of emitters? Or is it just a subsidized one? What about poorer people who can’t afford the subsidized price?

I’m not saying these are unanswerable questions. But I am saying these are very hard to answer questions, and because of their uncertainty, you can expect a massive pushback from emitters to reduce their cost. In fact, I would go as

So, you can see how those that appear simple are in fact arguably impossible.

Case Study C: Sea Level Rise in Developed Countries

Again, on the surface (pardon the pun) this seems rather simple. All one needs to do is calculate the sea level rise per gram emitted, then figure out the cost to major countries. This means finding out what the cost to build retaining walls per each mm of rising is, likely combined with the cost for some lost real estate. Again, this might not be

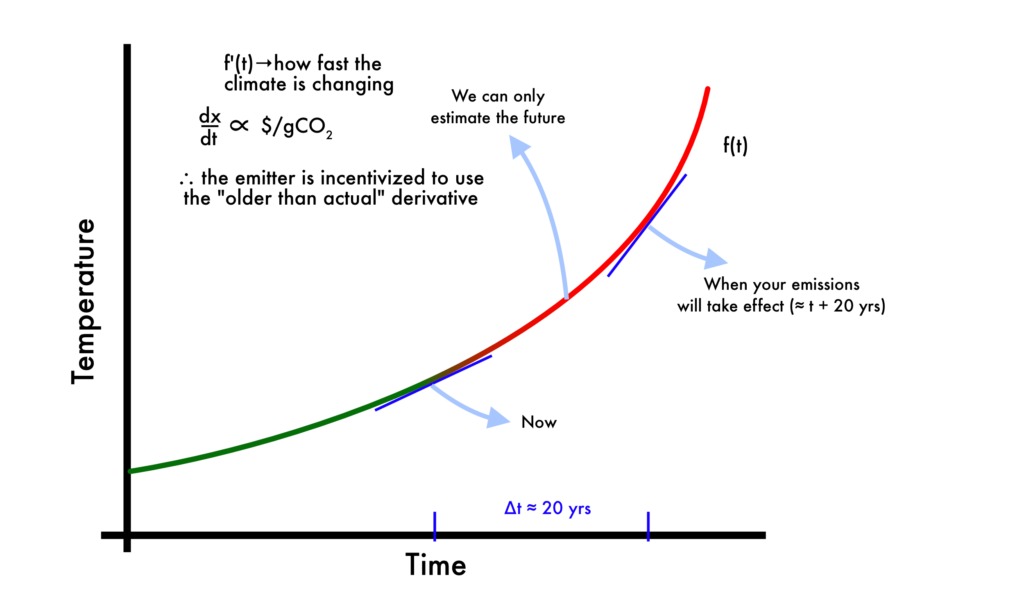

As I mentioned before, this uncertainty is deadly when it comes to actual implementation. Corporations can always argue that these calculations are uncertain—and be right. They will likely use this to avoid any carbon tax—essentially procrastinating—until they can find another way to get out of it. Essentially, you’re attempting to determine the derivative at a point on the graph that does not yet exist, which is quite difficult to justify. So, it might actually be better to use the current derivative, despite the huge flaw that it likely underestimates the effect because the second derivative is positive. But, again, we’re trying to find something that has the maximum positive effect, not just what works in theory.

Also, keep in mind this only works in developed countries, where physical protective barriers would likely be put in place. This does not deal at all with poorer countries. We’ll get to that later.

Case Study D: Increased Cost for Agricultural Water Supply & Decreased Efficiency in Crop Production

As temperatures increase, the climate changes and freshwater becomes less common across the Earth’s surface. Because of changes in temperatures, crops require more yet increasingly scarce water (a negative feedback loop). Over time, ground aquifers are depleted and the land becomes even drier. It seems rather simple to statistically quantify decreasing rainfall with the economic cost of an increase in water acquisition cost.

But it turns out to be not that simple. While some farmers will be negatively affected, some will actually be positively affected. Those regions that were previously too cold to farm have suddenly become bountiful and fertile lands. Are those people who benefit obligated to compensate those whose land has declined in value? That’s a difficult question… they aren’t consciously making a bad decision, which is what the carbon tax is meant to do: decentivize the combustion of fossil fuels. And with the declining fertility of warm climates, don’t we want to incentivize farmers in newly fertile regions to pick up the slack in terms of agricultural production? Don’t we need to fulfill our food shortages? But this would be punishing precisely those we are now depending on to eat!

I’m not sure—in fact, I’m not even sure if it’s more of a moral question or an economic one. It seems unfair to maleffected farmers to let the new farmers get off without any payment, but on the other hand, these new farmers are providing a service of global importance to the human population. And if we choose the morally correct choice would that lead to food shortages which cause people to starve (making the morally good choice the morally bad choice)?

By the way, don’t forget that the new land being used is likely previously undisturbed land that has now become fertile, so there will also be an increasing amount of habitat destruction to satisfy the human need for food.

These are really hard questions to answer. They’re very complex and intricate and nuanced topics don’t lend themselves well to political debate or 30-second attack ads.

Case Study E: Fish Populations and Their Effect on Food Supply Chains

Unsurprisingly, with increased ocean temperatures fish species are facing less favorable conditions. This, combined with overfishing, has led to dramatic reductions in fish populations and an increased reliance on fish farming (where fish oftentimes pollute water and are usually less healthy and nutritious).

Like before (this is getting repetitive now) we simply calculate the distributed economic loss for decreasing fish yields, combined with the cost of finding the solution in fish farms, and correlate this with per gram of CO2 emitted.

And you thought I was going to let this example get off easy!

Please indulge me for just a minute, for I need to have a brief rant about how the public’s perception of ocean temperatures. Feel free to skip it if you’d like.

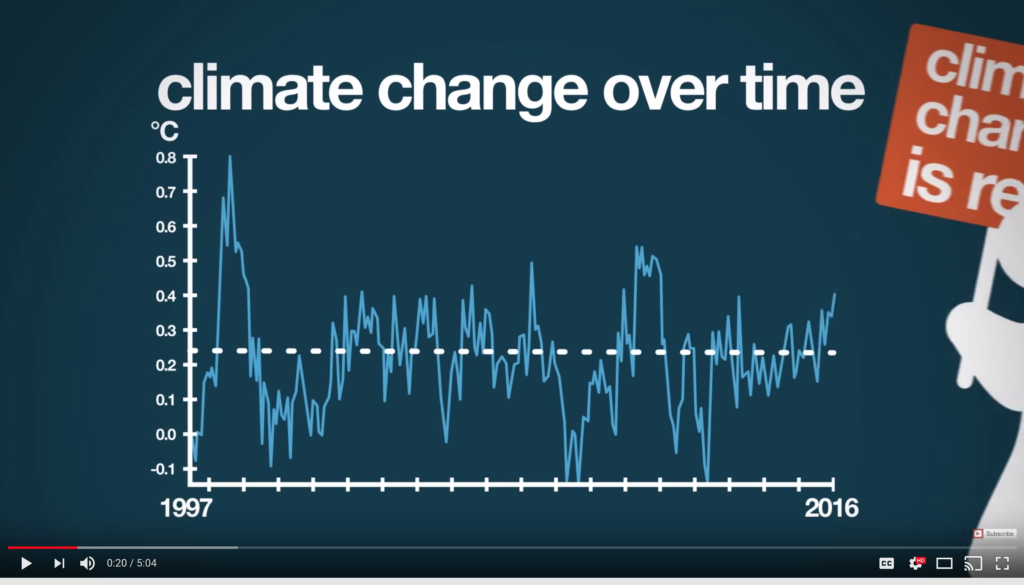

Interestingly enough, this can be somewhat misleading and is ammunition for climate change deniers. They see this part of the atmospheric temperature graph (as seen in this incredibly misleading video)

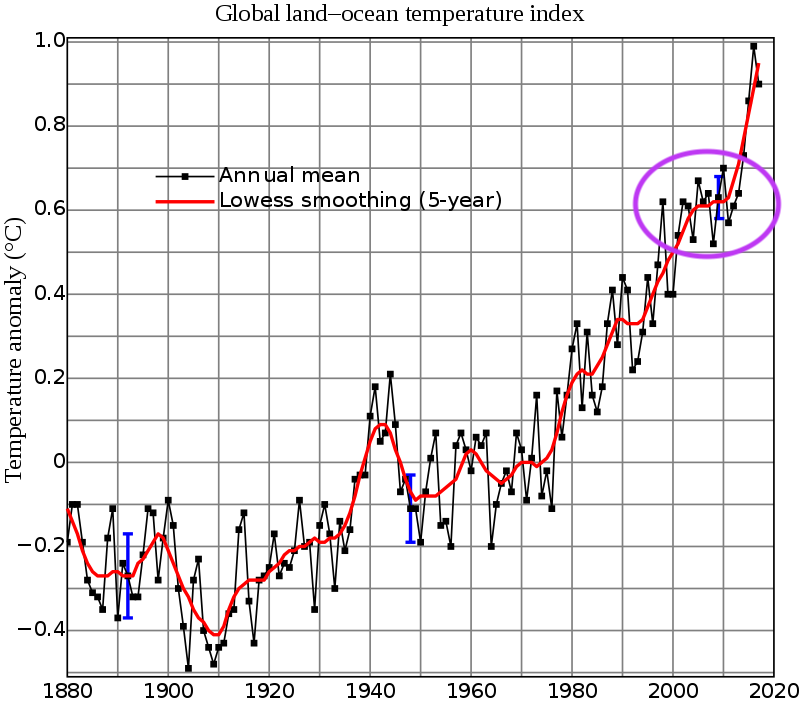

and say that “climate change isn’t real.” Unfortunately, they fail to realize that that is, in fact, a very zoomed in section of the overall temperature graph. It’s a common trick deniers use, and can be debunked with an analogy: even if you start from space and see the Earth is very much so round, if you zoom into the surface enough it will appear flat—and is literally flat when you zoom in an infinite amount. This trick is even used to a significant extent in physics and calculus for techniques such as Gauss’ law, and the effect holds true for data. It is much more honest when given more context, where it looks like this:

and you see that little flat spot that I circled in purple really doesn’t disprove global warming. I wonder why the author of the video chose the oddly specific and unconventional years of 1997-2016. 🤔🤔🤔🤔Also, that straight “chalk” dashed line–yeah, that’s not how trendlines work either. 🤦♂️

Case Study F: The Economic Value of the Great Barrier Reef

As you likely know, the Great Barrier Reef (GBR) is one of the most beautiful wonders of the natural world.

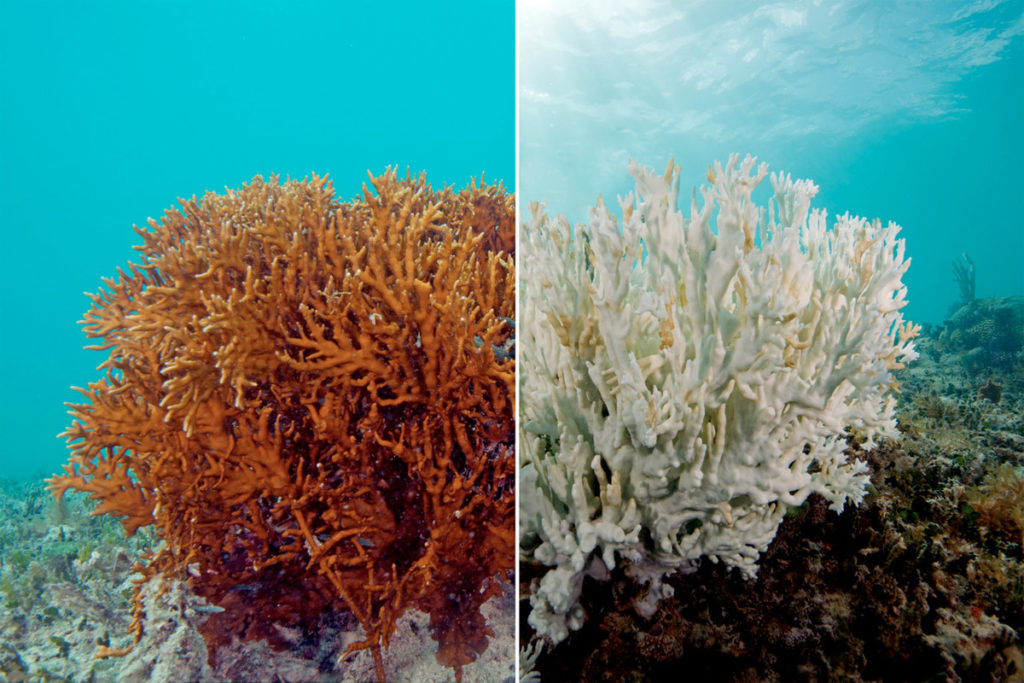

I mean, seriously. Check this out:

But, there’s the unfortunate fact that coral reefs are extremely sensitive to changes in the ocean’s pH. When we emit CO2 into the atmosphere, the gas essentially “dissolves” into the rest of the atmosphere, and through natural dispersion, eventually disperses itself more or less evenly across the globe. Obviously, this same atmosphere that has an increased CO2 concentration is touching the world’s oceans, and through basic

CO2 (aq) + H2O H2CO3 -> HCO3− + H+ CO32− + 2 H+.

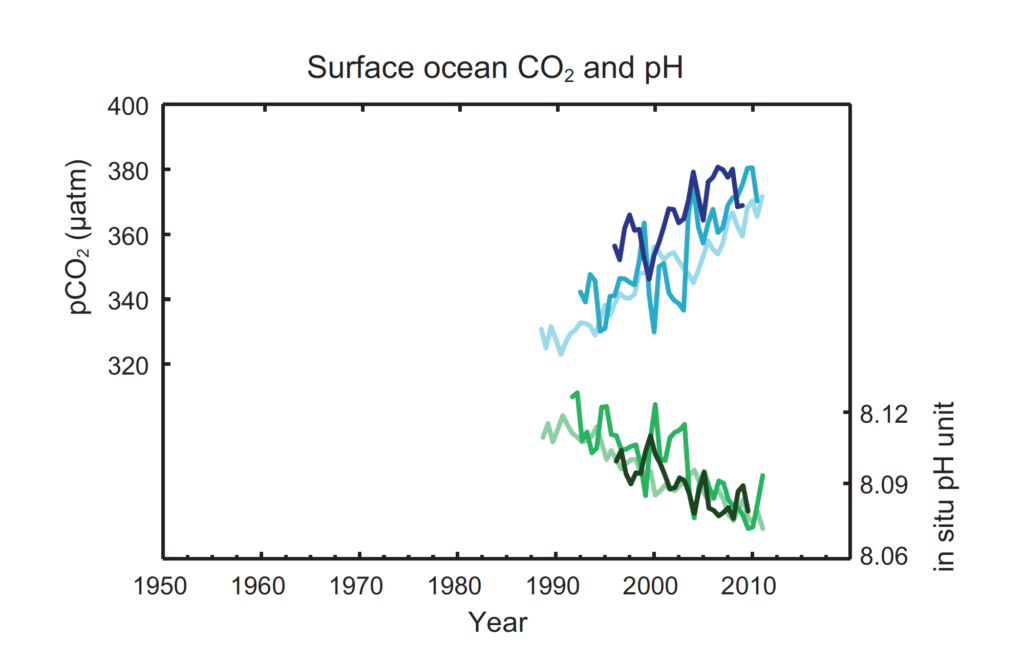

So, let’s take a look at the pH graph:

Now, due to that acidification, that immensely beautiful environment turns from this to this.

So how do we tax this? Remember, we’re only concerned with the economic impact of said destruction and narrow our analysis to that one area (don’t worry, I’ll pound this point to death later).

Essentially, we look at what Australia currently makes off of the GBR, which would be in tourism, and to a lesser extent, real estate. There isn’t a really robust estimate out there (not to say it can’t be done), but the best appears to be the WWF’s estimation of $5.4 billion/year. Maybe add a bit more for the real estate value of living near a worldwide treasure, but whatever—the economic “worth” is around there.

Ok, so I think those are a few representative case studies that we can use for comparison later, but it’s important to emphasize that there are so many out there. Some are easy to calculate, such as those above, and those that aren’t so easy that I’ll get to later, but it’s important to keep in mind that for

The IPCC takes a swipe at the “broad strokes” of the effect of climate change (fully quoted from them):

- Risk of death, injury, ill-health, or disrupted livelihoods in low-lying coastal zones and small island developing states and other small islands, due to storm surges, coastal flooding, and sea-level rise.

- Risk of severe ill-health and disrupted livelihoods for large urban populations due to inland flooding in some regions.

- Systemic risks due to extreme weather events leading to

breakdown of infrastructure networks and critical services such as electricity water supply, and health and emergency services. - Risk of mortality and morbidity during periods of extreme heat, particularly for vulnerable urban populations and those working outdoors in urban or rural areas.

- Risk of food insecurity and the breakdown of food systems linked to warming, drought, flooding, and precipitation variability and extremes, particularly for poorer populations in urban and rural settings.

- Risk of loss of rural livelihoods and income due to insufficient access to drinking and irrigation water and reduced agricultural productivity, particularly for farmers and pastoralists with minimal capital in semi-arid regions.

- Risk of loss of marine and coastal ecosystems, biodiversity, and the ecosystem goods, functions, and services they provide for coastal livelihoods, especially for fishing communities in the tropics and the Arctic.

- Risk of loss of terrestrial and inland water ecosystems, biodiversity, and the ecosystem goods, functions, and services they provide for livelihoods.

But it’s so important to emphasize: these are only scratching the surface. To continue our analogy, this is like when the ship hits the ice-globe, the first foot of the object it destroys. The ice-globe is hundreds of feet thick. It’s complex, sophisticated, and intricate, and our understanding of it and our effect on it only scratches the surface.

Our effect cuts much deeper.

So, know we’ve got a pretty good handle on the blindingly obvious stuff. The big ice-globe bit that sticks out of the water that even an inexperienced captain could spot and avoid.

Of course, as we discussed, that doesn’t mean compensations for this category would be easy to implement. Even the Titanic hit the perfectly visible protruding bit because of human recklessness. But it’s…relatively easy to avoid. Time to delve a bit deeper. Time to find out about that bit that lurks underneath. That invisible threat that we can avoid.

Part 2: Things We Know to Watch Out for But Are Very Hard to Justify and Calculate

Wow, that title is a mouthful. But you get the idea.

This is about avoiding the pitfalls we are aware of, of giving ourselves margin for what we can’t predict. Now, this makes perfect scientific sense. It’s essentially recognizing what you don’t know and making reasonable estimations/allowances for it. Scientists and other people who experiment (or do anything with even the slightest degree of uncertainty) do this all the time. But there is a problem. Because they are difficult or impossible to calculate, it gives industry

Let’s get started.

The Little Things

This is kind of the “you can fill a swimming pool with a drinking straw” argument. There are a million unthinkable little effects we have that all add up to a significant effect that has undeniable consequence.

Just a few examples:

Just a few examples:

- Car engines run less efficiently in hotter climates

- Our activity changes the color of the surface of the Earth, which in turn affects how much sunlight is reflected and absorbed (which scientists call albedo)

- Note: on a larger scale with the melting of ice sheets (white ice -> blue ocean water) this is actually a really sizable effect, and is definitely not in the “little things” category.

- Livestock requires more water to keep cool

- Making all those extra AC units I mentioned earlier would have a carbon footprint to make (all the emissions from mining the materials, refining the materials, and energy going into assembly).

- Less fly fishing when rivers become too hot and kill trout

I mean, I know what you’re thinking. A lot of those seem quite minuscule. After all, who cares about fly fishing (I do). But the point is that while I mentioned 5, there are 5 million I can’t think of. Combined they do end up making a big difference.

Natural Disasters

It’s not a stretch to say that increased temperatures result in an increased occurrence and intensity of natural disasters. Two examples:

- Forest fires:

- Because summer lasts longer, there is a larger time opportunity for a spark, etc. to occur and spark a fire.

- Summer is hotter, so vegetation is drier and more prone to burning.

- After a fire starts, the extreme heat makes it more difficult to fight and contain

- Hurricanes

- An increase in energy (physics: heat=kinetic energy of air molecules=energy) of the climate systems results in a higher number of storms and more intense storms

- An increase in energy (physics: heat=kinetic energy of air molecules=energy) of the climate systems results in a higher number of storms and more intense storms

But this brings up an important point. Many scientists agree that Hurricane Sandy was significantly more intense than it would have been had there not been global warming. But have emitters been sued? Have they paid damages for the storm that at the very least they made way worse? Nope. With the storms Louisiana is currently experiencing—that are in large part due to climate change—are emitters being blamed for that, either? Nope.

That’s because it’s really difficult to prove that causality. And even so, because of the delayed effect of the climate system, the molecules that contributed to the storm were released around 20 years ago.

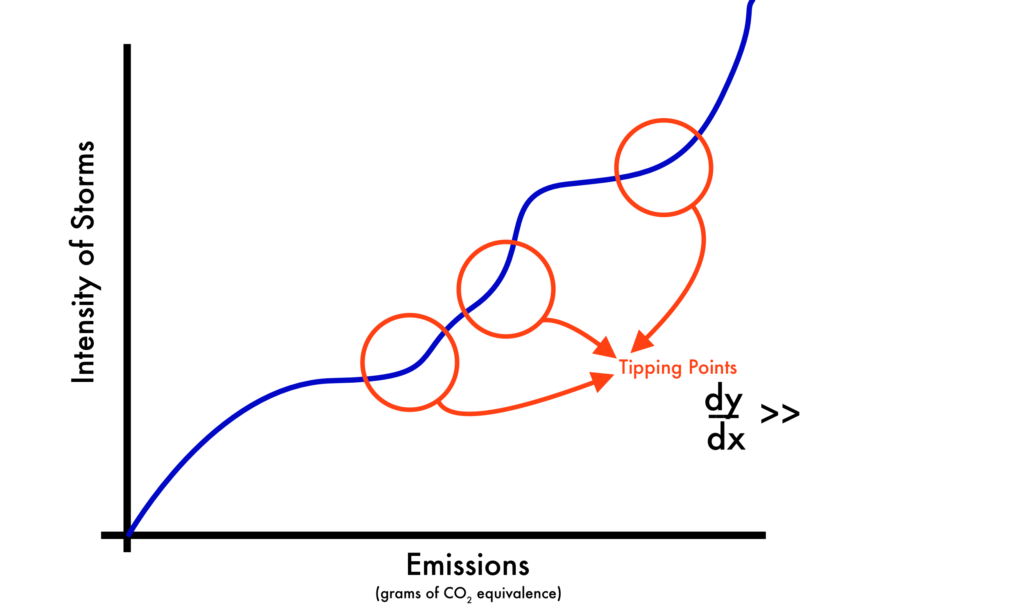

And also, it’s really difficult to identify a mathematical model for the causality of storm severity/gram of CO2 emitted. Is that relationship linear? I really doubt it. Then how do we find the curve? I have no clue. It would require a lot of historical data. But that’s a really hard problem because there aren’t many storms and there isn’t comprehensive storm data of the kind needed from pre-industrial times. My bet: there’s a tipping point that changes a storm to a hurricane.

Like this:

And if I’m right, where does the large expense lay? Is it less expensive to emit before that tipping point is reached, but then that one CO2 molecule is super expensive? Or should that effect be distributed back? What would each tactic incentivize? What, exactly, do we want to incentivize, anyway?

This leads to a larger point: put simply, our current scientific knowledge cannot meet the legal and legislative burden of proof required to force corporations to take action—and it may never. We have to try something else.

Trees

Trees. They’re pretty awesome, right. They make a lot of the oxygen we depend on to breath, and they suck CO2 right out of the atmosphere. They provide habitats for most of the animal life on Earth, create a way to easily transfer information (paper), and are even a source of building material and firewood. Trees are just fucking awesome!

But of course, we cut them down. Both for using them for paper, firewood, and building material, and also because we want to clear land for other crops or to build houses.

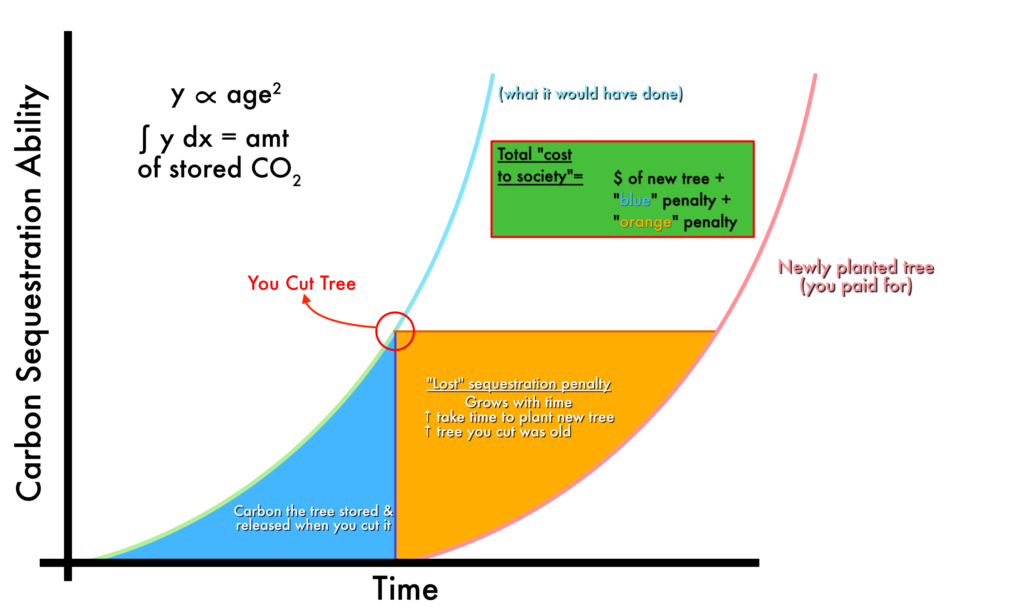

But, there are direct implications for a carbon tax, as organic plant life (predominantly trees) serve as the main carbon sink for the planet. So how do we tax them? Is it just a flat tax? I don’t think it should be, because when you cut down a tree you aren’t just releasing CO2 into the atmosphere. You’re preventing that tree from removing CO2 from the atmosphere—for however long the tree would have lived. It’s not linear—it’s an exponent of time. So, perhaps it’s better that we make it mandatory to re-plant a tree, and apply a tax proportional to the effect that time delay in the tree-CO2-action had. This graph might explain it better.

But, again, that is a very hard relationship to prove, with some trees being more valuable depending on what habitat they provide (which is in and of itself subjective), and all in all, this complexity is easy for corporations to fight. But, being said, this hidden exponent effect is one of those effects we do know to watch out for and give a wide berth when taking this into account.

Ocean Level Rise in Developing Countries

Earlier, I discussed how the economic impact of sea-level rise on developed countries could be calculated, with an algorithm combining the cost of physical measures (like seawalls, canals, etc) with compensation for property loss when economically advantageous. But I don’t think this methodology applies to

In many poor countries around the world, the government simply doesn’t have the money to construct physical protection for their citizens. Even worse—this land is oftentimes near worthless. If we used the algorithm above, it would always default to “compensate for property loss,” but when the property belongs to a poor farmer living off the land and making only a few hundred dollars a year, that could be little more than a few grand.

But—and this is my humanity speaking here—that is not right. It’s not right to uproot a person’s life and give them barely anything for it. How would we expect these people to recover? Few have

It is reasonable, then, that a different algorithm applies to

Those are tough, but not unanswerable questions.

They do, however, raise one of the more interesting questions that I’ve been mostly ignoring. Now that we’ve established a carbon tax, who do we give it to? That’s a new section in its own right.

Distribution: The Other End of the Equation

We’ve talked quite extensively about all of the difficulties of collecting a carbon tax, from the difficulty of quantification to the arduousness associated with defending said calculations against corporate interests. But we’ve only made passing comments as to all the difficult questions associated with the distribution of said tax revenue.

Some interesting questions:

- Does it go to cash-strapped governments? Or does a supranational body distribute to those individuals and organizations affected?

Let’s flush this one out with an example. We previously discussed the issues associated with collecting a tax for changes in the climate and those effects on agriculture.

Here’s what I said

While some farmers will be negatively affected, some will actually be positively affected. Those regions that were previously too cold to farm have suddenly become bountiful and fertile lands. Are those people who benefit obligated to compensate those whose land has declined in value? That’s a difficult question… they aren’t consciously making a bad decision, which is what the carbon tax is meant to do: decentivize the combustion of fossil fuels. And with the declining fertility of warm climates, don’t we want to incentivize farmers in newly fertile regions to pick up the slack in terms of agricultural production? Don’t we need to fulfill our food shortages? But this would be punishing precisely those we are now depending on to eat!

And, still, I don’t have an answer. Does the advantaged farmer have to pay the disadvantaged farmer as a cost of being successful? Or does society owe the advantaged farmer great thanks for picking up the slack in the global food supply?

Some possible options:

- Tax the emitters, give to the disadvantaged farmer

- Tax the emitters, incentivize/subsidize the advantaged farmer to build farms

- Tax the emitters, supplement federal budget

- Tax the advantaged farmer, give to the disadvantaged farmer.

- Tax the emitter, subsidize consumer’s higher expense for food & buying power

- Some combination of 1 through 3

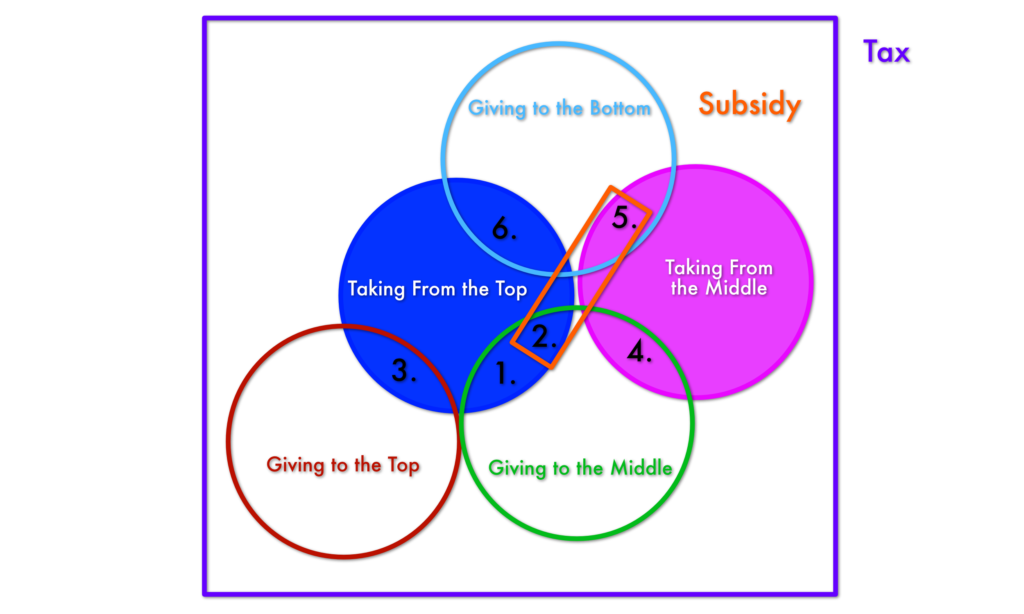

But let’s zoom out for a second. In that example, 1, 2, and 5 are fundamentally different from 3, which is fundamentally different from 4. 1, 2, and 5 are taking from the top of the economic food chain and giving to the bottom or middle, 3 is just taking from the top and giving back to the top (in a different place). And 4 is redistributing around the middle. Let’s visualize that.

This gets back to a classic economic argument: Trickle-down vs Keynesian economics. Is it better to give to the top, the bottom, or the middle? And when you do, who do you give it to? Essentially, which part of the diagram above is the best?

Countries have been fighting over this same principle forever, as have economists. I hope to delve really deep into that argument in a later post, but for now, let’s just say neither you nor I understand the argument enough to make an intelligent determination. So, in short, we don’t know enough to make an actual conclusion here.

We do know one thing, however: people of the world are very split on the issue. Whatever decision we eventually make must be implemented using the same guiding principles across national borders. Therefore, a consensus has to be made on the fundamental conjecture of the program.

But, because people are hugely divided on this issue, and won’t come to

I have glossed over one assumption I made in the previous paragraph, though. I argued the above conclusion based on the opinion that the world must come to

- Because many of these issues are cross-national, the system wouldn’t work if different nations had fundamentally different approaches. Think of the sea level rise on developing countries example.

- I think this makes a huge argument for a supranational entity administrating the policy, but I do think there is a way to do this with cooperative governments; it isn’t an immediate disqualifier.

- Supranational corporations are quite numerous and absolutely integral to the global economy. I would suspect these corporations would be put in a real tough spot if some countries incentivized some activities while others

decentivized those same things.- First, this could paralyze the global operations of said corporations, leading to a breakdown of basic services

- Second, because the policy isn’t uniform, these corporations could find a place where nearly any activity is incentivized. Because emissions don’t play

be the same rules, the policy wouldn’t have any actual effect on total CO2 producing activities. It would simply change the location of the emitter.

In sum, I think this is representative of a major flaw with a carbon tax. In order for it to be effective, I think it must be moderately uniform. Because of the current political climate, I just don’t see that happening. Countries operate differently, their citizens have different desires, customs, and worldviews (not to mention various degrees of scientific understanding).

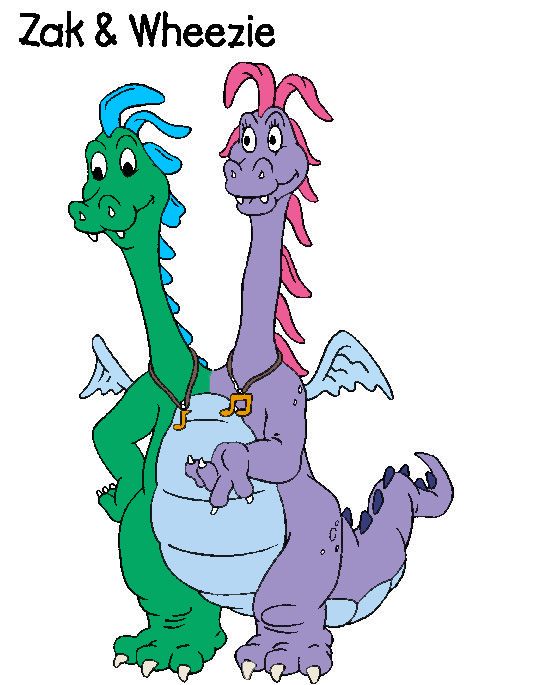

Yet, we’re all on one earth. It’s kind of like that character from Dragon Tales (a TV show I used to watch when I was a kid). There was that one character that was really two characters—two heads shared one body.

And, quite comedically, they oftentimes disagreed. But when they disagreed in regards to where they should physically go, they were left paralyzed. Which often leaves the one who feels they are right making this face

Now it’s funny when it’s a kids TV show, but this is real life. And unlike the TV show, there are real consequences. So the best comparison I can make is this:

The world is a multi-headed dragon, with many many different countries wanting a say. But we can’t take any action unless everybody (or mostly everybody) agrees at least on a general direction of where to go. But we’re not sitting on a lawn chair—we’re standing in the middle of a railroad track, with a massive train bearing down on us (which we set into motion, by the way).

If we disagree, which we most certainly will, we’ll go nowhere. And that means we’ll all get hit by the train.

But, I digress…

Part 3: Those Where Uncertainties Are Too High and the Intrinsic Value is Fundamentally Subjective

Now, getting back to our iceberg:

Finally, we got to that section directly underwater. That section no one cares about, but without the ice-globe would not float. It’s the foundation of the mansion that no one sees or cares about, but without it, there would be no chandelier.

The idea contained in this section is the one that actually got me to write this post. It’s, in my opinion, the most glaring flaw of the carbon tax in its current incarnation. Even if you disagree with everything I’ve said previously, this should show you why I believe it is, truly, morally abhorrent to implement a Carbon Tax the way it’s currently being discussed.

It’s because when we go back to what a Carbon Tax truly is—including the “cost to society” in the capitalistic equation, everything we’ve talked about so far is only scratching the surface. We haven’t even gotten close to talking about the true cost to society. Through the lens we’ve been viewing this, we’ve been incredibly insular. Narcissistic even. Looking through a capitalistic telescope when we should have been looking through a wide angle lens.

Let’s go back to our very first example: health care. We discussed statistically inferring the increase in conditions requiring medical attention. Right. That seems totally fine. There really isn’t another way to discriminate between the what-would-have-happened-anyway conditions and climate-change-caused condition. But what did I do next? Seemingly without thought, I went directly to the economic impact of those hospital visits. I went to how much do we have to pay the doctors, how much drugs do we have to give them, and what’s the patient’s lost productivity dollars.

But think about it. When you’re sick, especially with serious conditions, it sucks. It’s more than just lost pay—you’re in pain. And if you die, it’s not just your lost productivity; it’s the fact that YOU LOST YOUR FUCKING LIFE—that your children will never see you again, that your spouse will die alone. It’s the same question that happens when planes crash due to negligence by corporations: what is a life worth?

The issue here, however, is that we can’t apply the same methodology. Not to negate the humanity of those who lost their lives to accidents like those I mentioned, but this is a much bigger problem. This isn’t a hundred or two hundred people every few years, dead due to a single and identifiable cause. This is 7.2 billion people (and growing) who are all being affected in some way. This is tens of thousands (perhaps millions) of more heat strokes a year, more heart attacks. This is a bigger problem, not just by a little bit, but by orders of magnitude. An airplane crash is either an accident, negligence, or some combination of those two. This is an economic calculation. How incredibly cold does that sound!? People choose to get on an airplane—they acknowledge that risk. People can’t choose whether or not to be affected by climate change.

It’s just like with parents. Whenever you, as a parent, take your kid in the car, you realize there’s a chance she could be killed in an accident. When you buy her a bike, you are acknowledging the inherent risk that she might be killed by a car or my fall and crack her head. When you get on a plane, you realize you’re getting into a magic metal bird that will shoot you across the sky at more than five hundred miles per hour— in what is essentially a pressurized Coke can. But when you’re affecting the atmosphere, you’re affecting everybody. Those you are affecting don’t have a choice. You have taken that from them.

Let me tell you this: that is wrong.

Now let’s take that example of the effect of sea level rise in developing countries. I had mentioned that “that’s not right,” when referring to uprooting people’s lives, but I was really just touching upon this point. Yes, we can compensate these people for their land (although that price needs to be really the full “relocation” price). But can we compensate them from moving from lands they have inhabited for generations? Can we compensate them for the fact that (through sea level rise) we just destroyed everything they hold sacred? Not just places they “value”, but oftentimes local religions have literally sacred places. Imagine if the Vatican had to be sacrificed—sure, you could pay to move the paintings and some of the other important pieces, but you couldn’t compensate the Catholic religion. Not truly.

Because, inherently, what we defined at the “cost to society” is fundamentally missing the human cost. It’s that unquantifiable, emotional aspect to humans that we just can’t ignore. It’s the realization that nothing has intrinsic value—that the very word “value” isn’t signifying true value—but what humans emotionally value. It’s the realization that there is no such thing as value, because there is no economy without humans. Without humans and human emotion, everything is worthless; and at the same time, everything is priceless. Everything, just is.

But this goes much deeper—it’s not just that these corporations are making that decision for all humans—they are making that decision for all species residing on planet Earth. They aren’t just playing with individuals, or even families, in their game of numbers. They’re playing with the extinction of species.

Let me ask you this: what is a Polar Bear worth? What is it’s

How about

But what about this thing:

That’s the Bramble Cay melomy. Or rather, it was. It went extinct a few years ago— no one knows exactly when. And it’s, officially, the first known mammal extinction due to human-caused climate change, sea level rise to be specific (though there have likely been others, and there certainly have been untold numbers of birds and insects that have suffered similar fates due to us).

So, what’s that thing worth? Collectively, what’s the worth to society? $1? Maybe. Because it’s not sexy. It’s not glamorous. It’s not beautiful. Because it’s an ugly rat.

But does that rat have any less right to live? Do we have any more right to destroy that species—forever—than we have the right to destroy Polar Bears?

Don’t you see what we’ve done?! We, humans, are subjectively deciding the value of these species on what we think is “romantic.” That’s fucked. Honestly, that’s one of the most fucked-up things I’ve ever heard. It’s way worse than “who has a greater right to live.” It’s what species has the right to exist, forever.

It probably didn’t know it was the last of its species.

But this bird did:

It’s the Kauaʻi ʻōʻō, and its song was last heard in 1987. Here’s the last known recording of its mating call:

That makes me cry every, single, time.

Just for a second, put yourself in the shoes of that bird. The last one. Imagine being the last human. You’re calling for someone—anyone—but no one responds. You wander the empty streets of the world, seeing nothing but dead people and emptiness. Nothing. You realize that once you die, you are the last human, ever.

You realize it’s all led to you. You are it. Leonardo da Vinci, Jesus Christ, Abraham Lincoln—they have all led to…you. You are the last representation of our species. You are the last one to ever live. And you will die. And humans will be gone forever.

To me, that stirs up some of my greatest emotions. Of despair, anger, hopelessness, and responsibility. What makes it worst is that that has happened to so so many species because of us.

But to go back to it for a second, imagine some alien had caused this. Not intentionally, but just as a byproduct of them turning their lights on and heating their water. What do you feel you would be worth? What would you pay to not be the last one, to know that you won’t be the last human? I imagine quite a lot.

But imagine that alien ignores your pleas. Whatever—“I think you’re ugly.” And then you breathe your last breath.

That’s what we just did to the Bramble Cay melomy, and to the Kauaʻi ʻōʻō.

What are these things worth? What’s the worth of the rain forest? What’s the worth of the Great Barrier Reef?

We all know it’s not just the tourism value. It’s one of the most beautiful, bountiful, and vibrant centers of biodiversity on Earth.

According to the WWF, it’s home to more than 1,500 species of fish, 411 types of hard coral, one-third of the world’s soft corals, 134 species of sharks and rays, six of the world’s seven species of threatened marine turtles, and more than 30 species of marine mammals, including the vulnerable dugong.

What are those species worth? What would you pay to save it?

Because we, as a society, have not given it a value, it’s worth a very precise amount: $0. It’s worthless. That’s how society treats it today, and that’s how it would be treated under any carbon tax with a quantifiable derivation.

That right there hits home at the biggest single problem with a carbon tax. It doesn’t value life. It doesn’t value the priceless.

My Solution

Now, it would be fair to say I’ve been doing a lot of complaining during this post. I’m lamenting that what seems to be the most progressive idea we have to overcome climate change is inherently so flawed, and that so many smart people haven’t brought up this point. I’m also lamenting that these same smart people don’t realize it’s essentially impossible to implement, for reasons I’ve discussed ad

But I’m not going to just complain. I don’t think that’s helpful. Too many people in the world just complain—without actually proposing a comprehensive solution that makes sense. This happens so much in politics; it drives me crazy. (I guess that in and of itself is a complaint, but whatever.)

What the carbon tax, does, fundamentally, is adds that “cost to society”. But what is the “cost to society” in that context? It’s, essentially, the literal effect of those emitted atoms. But as we’ve shown, that’s flawed. We have to look at it a different way. Instead of looking at the value it destroys in society, let’s look at something much more definable: the cost of finding a real solution.

When you think about it, it’s actually not that hard to define. There are tons of solutions to sustainable energy production out there, none are currently cost effective. But, what if we just charged this tax to literally pay for state-owned energy production facilities? That would have the outcome we want: it would simultaneously discourage emissions while literally constructing a solution.

Now, I want to provide an actual path, so I’m going to pick one very easy solution: worldwide concentrated solar farms with

Let’s run some loose math on this. Excel to the rescue!

Warning: Math Ahead

First, we have to define our energy requirements for a solution. Note that I say energy, and not electricity (energy is more inclusive) because once we transform our transportation from fossil fuels to electricity the grid demand will rise proportionally. So, being conservatively high, we’ll assume that 100% of human energy consumption comes from the grid.

In 2013, the total human energy consumption was 3.89 × 10^20

If we have a reasonable estimate of 200 W/m^2 for solar panels today, we divide the two, meaning we’ll need 139,798,477,929.99 square meters of solar panel to power the entire Earth. If we made that a square, each side would be 373.89 km long.

Let’s put that in perspective. Nevada’s area is 286,351 square km, meaning this solar panel array, that would power the entire Earth would be about 49% the size of Nevada. Now, I realize that some extra space needs to be added for the batteries, but not much more.

Distributed over the world’s entire surface area, this isn’t really that big. It’s doable. For comparison, if we just took the U.S.’s share, it would only cover about 1.4% of Nevada. That, we could definitely do. And it would be reasonably the same for most countries.

Now, let’s talk cost. Obviously, ordering in bulk helps, but let’s assume that the prices don’t go down. Generally, the cost—installed, is about $1.75 per watt. Using our calculations, this is about $36.884 trillion. We then have to compensate for the batteries to store energy during nighttime and adverse weather, which is generally a big cost multiplier. Let’s assume a conservatively large multiplier of 1.75X. That gives us $64.55 trillion.

Ok. I know what you’re thinking. That’s a shitton of money. Yes, you’re right. But let’s see how much this would actually affect the citizens of the world.

Let’s say that we want to implement this

Ok, let’s find out the cost per gram of CO2. The total carbon emissions for 2014 was about 10.795 GtC (gigatonnes of carbon). Of course, CO2 has two oxygens in there, so total CO2 emissions

Note: this is a simplification because it’s not including other GHGs. I would suggest looking at the weighted efficacy of those gasses in comparison to CO2 and charging that way.

Converted to grams, we emitted 4×10^16 grams of CO2. Divided by our required revenue per year, that equals out to 0.00006455 dollars per

In the U.S., the average home consumed 10,932

Converted to the month, that’s an average $30 per month for the average U.S. household.

Let’s see about gas. In the U.S., the average price per gallon for regular over the last 10 years was $3.09, and on

(I know that seems crazy that about 6.3 pounds of gas would emit 19 pounds of CO2, but keep in mind most of that mass comes from the Oxygen in the combustion.)

Multiplying that by our cost per gram gives us $0.575 per

The average American will spend about $20.74 extra in gas tax every month.

Now, let’s talk. These are the two major areas in which Americans emit most, and while prices for other things will be sure to increase as well, it will be significantly less noticeable. Combined, we’ve come up with an extra $50 a month in expenses for the average American household (that owns one car

I have to be honest: I’m incredibly tempted to write off this number as small, as a negligible increase. And indeed, for my family, and those around me, it would be. For most

But, I have to check myself: I do realize that while that expense seems inconsequential to me, it isn’t for many people. Really, I do recognize that for some people in the U.S., they simply couldn’t bear that amount. It’s too much. They would have to choose between that and feeding their families. It would make it harder to work because their commute would become significantly more expensive.

First, there are a few remedies for this. It’s likely it wouldn’t be that hard to make that tax “income aware,” just like our current income tax is. Perhaps the poor wouldn’t have to pay, and that cost was distributed to those who could. Perhaps governments could cut a few a few billion dollars from their defense budgets to pay for those who can’t. While I don’t think this part is easy, I am confident there is a solution.

But the bigger message here is that this is doable, guys. This is a real solution, that is well within the realm of politically feasible to implement, that we know will work.

After all, taxes were increased way more than that during various points in American history, such as WWII (when you look at a person’s total taxes holistically). In the past, in the US and elsewhere, people have been asked to make sacrifices for the greater good. Whether eating less, to growing food at home, to going to fight overseas and likely lose your life; when our leaders have told us: “this is the fight of a generation… you aren’t just fighting for the now, you’re fighting for the right of your children to live freely”… We’re responded “yes, I think this cause is that important that I will volunteer to go give my life.

If we can muster this patriotism, this sense of duty, towards fighting for freedom, why can’t we muster it for saving the world? Let’s convince people that the threat really is that large, that this is the sacrifice of a generation. That when our descendants look back on us, they will see us as heroes who recognized the danger just in time. And we aren’t even being asked to die for this. This is paying $20 a month.

In my opinion, this isn’t even an argument. It’s a moral choice.

Final Thoughts

Let’s end where we began.

I began this post by stating that the Earth was in immense

Then, we evaluated the concept of a Carbon Tax. In principle, it does make sense—sort of. But as I’ve shown, even for the things it can include, it’s practically impossible to implement in the current political and legal climate.

Takeaway #1: Shit is too Complicated

But that’s not even the most important point: inherently, our world doesn’t have value. Value is fundamentally a human invention. In the process of trying to approximate the “social cost” of climate change (and emissions), we’ve attempted to put a price on the Earth. We’ve tried to ascribe monetary cost to the extinction of entire species.

Takeaway #2: Not only is that morally wrong, but it’s fundamentally impossible: we cannot price the priceless

The thing is, no one created the Earth, and no one owns our world and the species that inhabit it.

Yet, it seems that without putting a price on life, we, paradoxically, cannot save

So, I propose a solution. Instead of evaluating the “cost to society” from what we lose as a result of an action, let us define it as the cost to remedy the action. Let’s not define the “cost” as the ramifications of the problem, but as what we as a society need to do to fix the problem.

First, we need to take responsibility. We need to realize that if anyone is going to do this, it’s going to be us. We need to accept the truth that in this case, lack of action is the same as

Also, we need to realize that our descendants will look back on us, during this time especially, and that we have the power to determine what they think. We need to understand that we have huge leverage on the future right now—and that works for both good and bad.

In the end, it’s

Yet, in this case, self-preservation and justice are one on the same—it just matters that you view things through a long-term lens. Do we have the courage? When the stakes are this high, do we have what it takes?

No generation has ever been posed this question. We. Must. Answer.

So, I implore you, all my fellow humans: value the priceless.

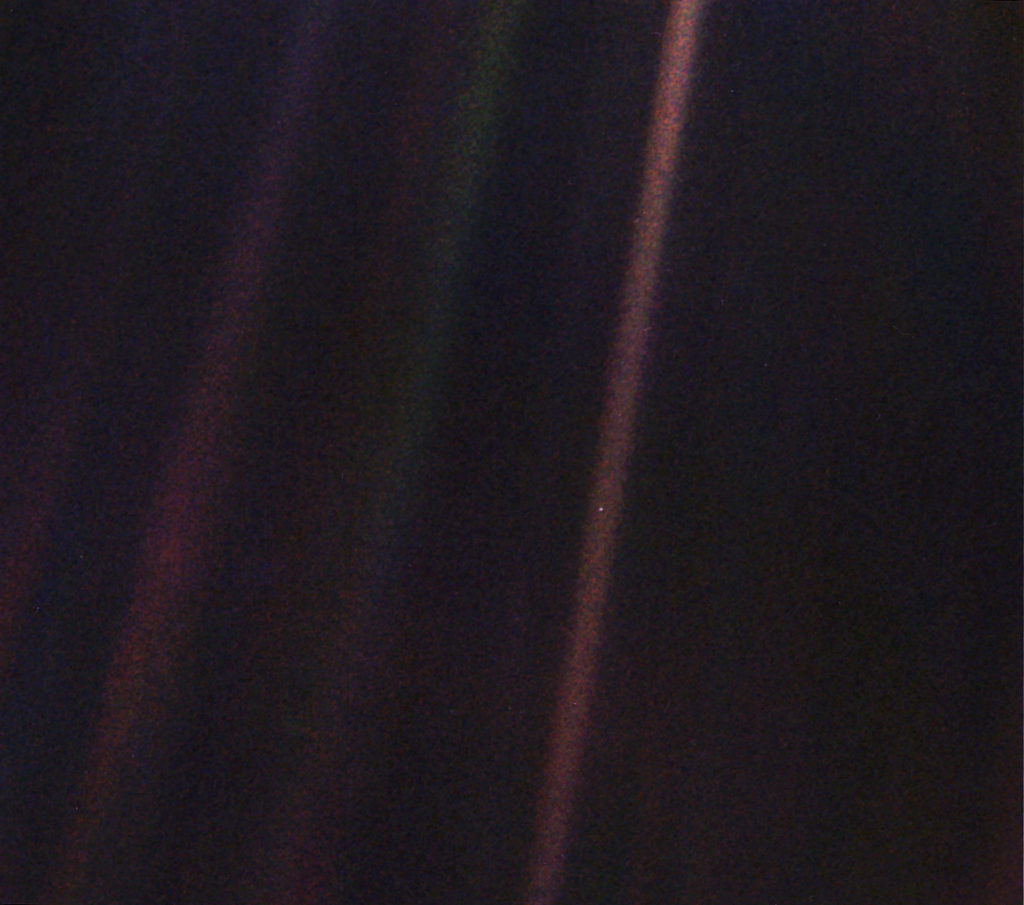

“There is perhaps

no better demonstration of the folly of human conceits than this distant image of our tiny world. To me, it underscores our responsibility to deal more kindly with one another, and to preserve and cherish the pale blue dot, the only home we’ve ever known.”

—Carl Sagan

August 13, 2016